The Most Popular Water Bottle Brands in America

Water is the ultimate unifier, and how we transport it has gotten quite the makeover in the last decade. When we used to rely on getting water from an errant water fountain or a plastic water bottle from a vending machine, we must have been incredibly dehydrated from not having water with us at all hours of the day.

Reusable water bottles were once reserved for athletes and outdoor activities. But then, they transitioned from a hydration necessity to an eco-friendly plastic bottle alternative. Suddenly, it became customary to carry water with us everywhere, and if you didn’t, weren’t you thirsty?

Most recently, though, water bottles have served as a coveted accessory that denotes a certain sense of style or even association with a subculture.

Consider the r/HydroHomies subreddit with over 1.2 million “H20Gs,” where Redditors come together to debate over such topics as whether a water bottle can be too big, or the trending #WaterTok, where “momfluencers” show off their limited edition Stanley tumblers and other H2Obsessives help each other hack their water so that it’s finally palatable. Gen Z has even had the unusual distinction of having a water brand named after them.

One thing is sure: hydration is hot.

With so many water bottle brands, which ones do people love the most? We surveyed 3,000 Americans to find out which brands are top of mind online, are already owned, and are considered the highest quality with the best reputations. Digging deeper, we also wanted to know if people are buying water bottles for their performance or because of their potential to elevate a person’s perceived social or economic status.

Key Findings

- Stanley is the most searched water bottle brand on Google in 19 states and the water bottle with the best reputation, according to our survey.

- Yeti, Hydro Flask, and Stanley are the most-owned water bottle brands.

- Quality is the top factor for water bottle purchases.

- Klean Kanteen was rated the highest-quality water bottle brand, with Owala being a very close second.

- 82% of respondents said a water bottle brand’s reputation influences purchasing decisions, but 69% have never felt influenced to purchase a specific brand because of its perceived status.

- Whether a water bottle is considered a status symbol depends on who you ask, with 49% believing that owning a particular water bottle is seen as a status symbol, while 51% do not.

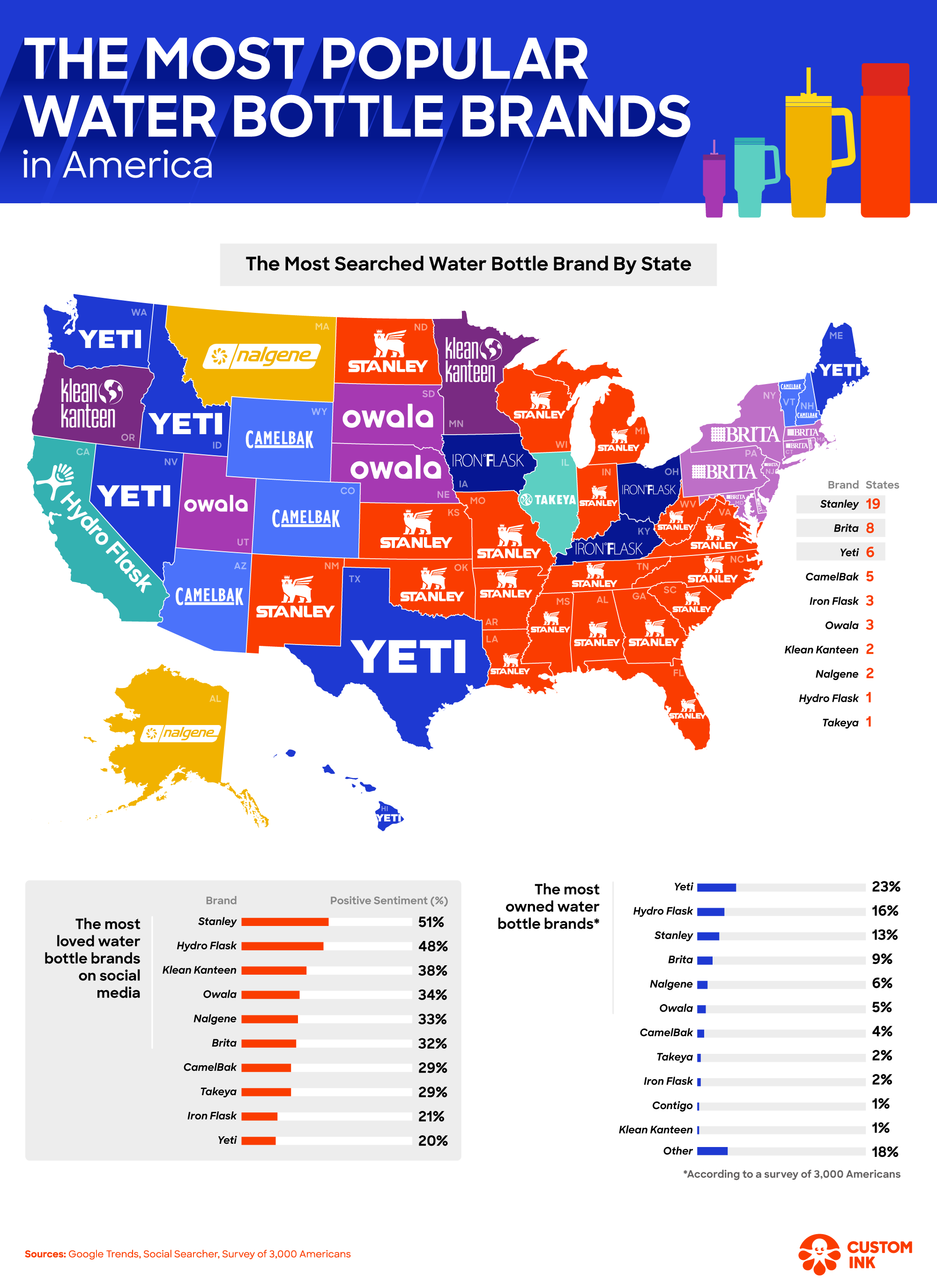

The Most Searched Water Bottle Brand by State

Given water bottles’ newfound power to unite people, we wanted to know which brands people search for most in the US.

It should be no surprise that Stanley came out on top by a wide margin. Residents of 19 states (38%) searched for Stanley Tumblers more than other brands. That’s already an impressive number, but Stanley also appears to have a stronghold over most of the South and Midwest, with New Mexico being the only state outside either of those regions to search for the Stanley brand as much.

While the next most searched-for brand, Brita, only captured the attention of eight states, it has a significant presence in the Northeast region of the US, with Maryland being the only state sitting just on the Census border.

Yeti came in third, with states dispersed in the West, South, and Northeast. CamelBak favors the coastal weather and has five states in the West and Northeast.

While Stanley has the attention of most of the country, some regions still indicate clear preferences for specific brands.

The Most Loved Water Bottle Brands on Social Media

Just like the most Googled brand, Stanley is the social media darling of this bunch. Stanley has benefited from garnering the attention of influencers on Instagram and TikTok, many of whom are Gen Z and Millennial moms, who praise the tumblers for their durability, many color options, and tapered design that allows them to fit into cupholders. If that weren’t enough, the tumbler also went viral for surviving a car fire and keeping the contents cold.

Stanley pulled ahead once again with a 51% positive sentiment, but Hydro Flask is very close behind with 48%, likely due to VSCO girls including them in their starter packs along with reusable straws.

Social media has potentially played a large part in water bottles becoming instrumental in bringing whole communities together, especially online.

The Most Owned Water Bottle Brands, According to a Survey of 3,000 Americans

We know what the Internet says about water bottle brands, but which ones do Americans own?

Even though Stanley came out on top online, Yeti is the brand that more people own, with 23%—perhaps because it is the most popular brand in Texas, which has the second-largest state population.

The next most-owned brand was Hydro Flask, with 16%. Hydro Flask may have been the most searched brand in only one state, but it clearly helped that that state was California, which has the highest state population in the US.

Stanley trailed behind at 13%, possibly due to it repeatedly selling out thanks to its virality.

Most notable, though, is “Other,” which came in second with 18%. There are undoubtedly many other reusable water bottle brands out there, and this statistic may indicate that online trends and viral content do not always sway consumers. They may focus more on the practicality and convenience of reusable water bottles rather than the flashiness of a viral brand.

A water bottle brand’s online presence can influence its reputation and cause a craze. However, people seem to purchase less popular brands and prioritize hydration over reputation as well.

Are Certain Water Bottle Brands Status Symbols in America?

With such a hullabaloo over water bottles in recent years, we wanted to know how people’s perception of brands has changed and what influences their purchasing decisions.

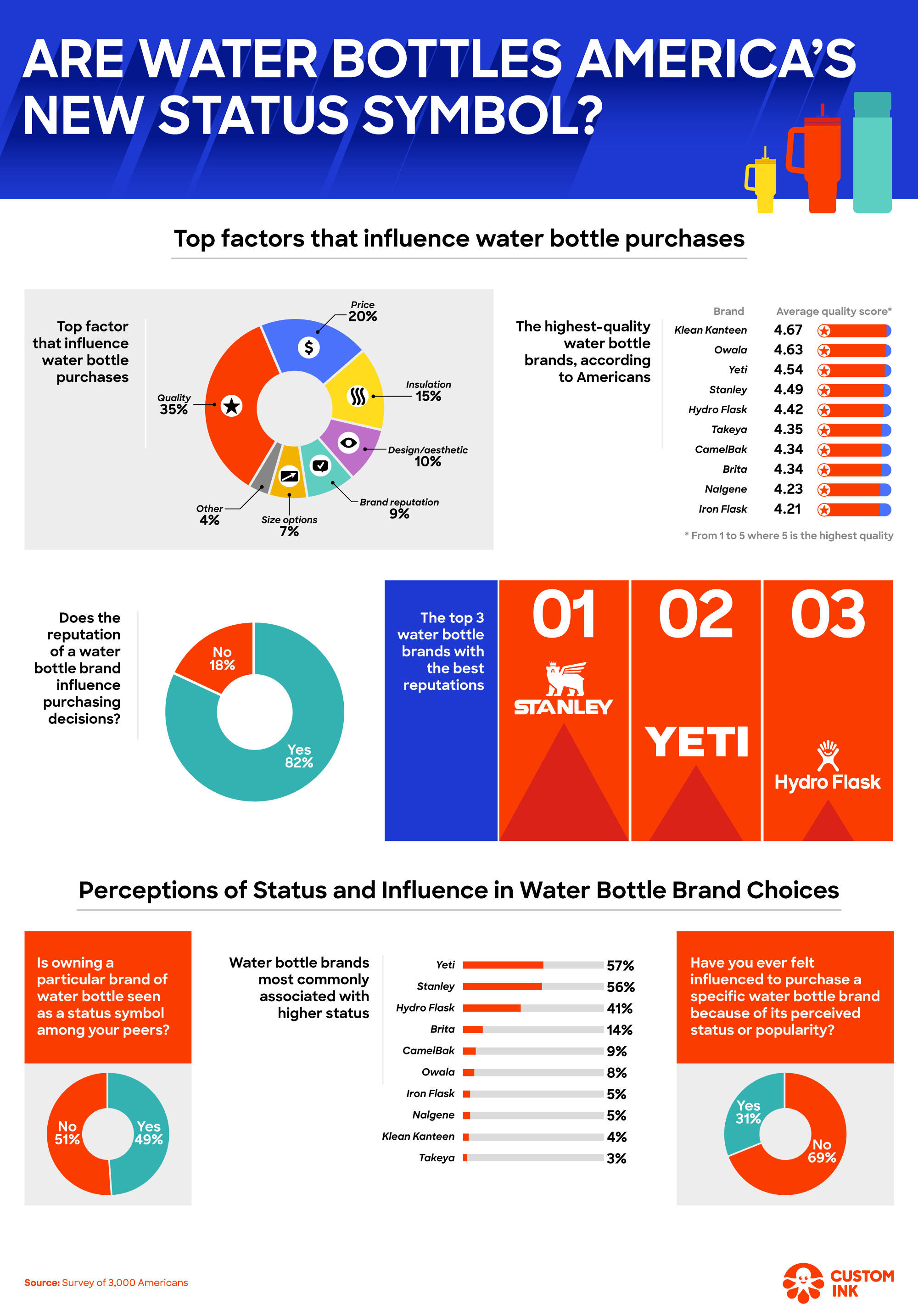

Key Factors and Brand Preferences in Water Bottle Selection

Consumers consider many factors when shopping for a water bottle. According to our survey, their primary concern is quality, with 35% voting for it as a top factor. The next leading factor was price, with 20%. These results may indicate that people are looking for a combination of excellent quality at a reasonable price—since reusable water bottles can cost upwards of $50.

Respondents also voted on the highest-quality water bottle brands, and we saw two brands break into the top spots. Klean Kanteen was voted as having the highest quality with 4.67 on a scale of 1 to 5 (where 5 is the highest quality), and Owala was just behind it with 4.63. The brands coming out on top previously (Yeti, Stanley, and Hydro Flask) were just behind them.

Insulation (15%), design and aesthetic (10%), and brand reputation (9%) were less of a factor for respondents, which could be surprising given that these are the very attributes that make other brands so popular. Based on this survey question, people seem to value the overall functionality of their water bottles more so than the brand.

However, when we asked respondents, “Does the reputation of a water bottle brand influence purchasing decisions?” an overwhelming majority (82%) said yes. The three brands with the best reputation were: 1.) Stanley; 2.) Yeti; and 3.) Hydro Flask.

These results show that respondents don’t necessarily associate brand reputation with quality. Klean Kanteen, for example, may be considered the highest quality, but it was only the most searched brand in two states (Oregon and Minnesota) and accounted for only 1% of owned brands. Yet, its positive sentiment on social media was 38%. Given these surprising results, choosing a water bottle may be more nuanced than we think.

Perceptions of Status and Influence on Water Bottle Brand Choices

As we’ve seen, brand reputation can impact selecting a water bottle, but what about its potential to be a status symbol?

When asked if owning a particular water bottle brand is seen as a status symbol among their peers, the results were nearly split: 49% said yes, and 51% said no. Given such a rare split, it depends on who you ask, and it also depends on the brand in question.

The water bottle brands that were most commonly associated with higher status or economic standing were familiar yet again: Yeti (57%), Stanley (56%), and Hydro Flask (41%). These results align with the most-loved water bottle brands on social media and those with the best reputations, which could indicate how social media has shaped water bottle brands and water bottles’ journey from hydrating vessels to sought-after eco-friendly accessories.

However, when asked if they have ever felt influenced to purchase a specific water bottle brand because of its perceived status or popularity, 69% of respondents said no, and 31% said yes. The majority seem to care more about quality and functionality, but the remaining respondents still feel that a brand-name water bottle could elevate their perceived status.

Opinions over whether water bottles are status symbols may be split, and many say they don’t feel influenced by their status, which seems to indicate that it depends on who you ask. However, when taking into account that 82% believe the reputation of water bottles influences purchasing decisions and the most-loved brands on social media are also most commonly associated with higher status, these may be stronger indicators of how we view water bottles today, even if many people aren’t influenced to buy them for that reason.

Conclusion

Based on our findings, the relationship between people and their water bottles is rather nuanced. Quality, price, and functionality are crucial for many respondents when purchasing a water bottle, but many respondents also agree that brand reputation has an influence. Moreover, while only about half of people say they feel influenced to buy a water bottle based on its perceived status, the most owned brands (Yeti, Hydro Flask, and Stanley) are also the same brands with the best reputation, according to our survey.

Water bottles play a flexible role in our lives—both as a necessary part of a healthy and sustainable lifestyle and a coveted accessory, giving them the power to elevate our status, signal to our communities, and ground us in our most common, everyday needs.

Methodology

The survey was conducted in January 2024 and targeted a sample size of 3,000 Americans. The respondents’ demographic distribution included a median age of 35, with 54% identifying as women, 44% as men, and 2% as other.

Data was collected using Google Trends on January 5, 2024, and spanned the entire year of 2023.

Data was also collected from Social Searcher on January 5, 2024, sourcing from the web, Facebook, X (formerly Twitter), YouTube, Instagram, and Reddit.

About Custom Ink

About Custom Ink

Custom Ink has been helping teams, businesses, schools, and families create custom apparel and promo products for over 25 years. Whether you’re designing custom t-shirts for a company event, hoodies for your sports team, sweatshirts for a family reunion, or custom hats for your business, our free online design lab makes it simple to bring your vision to life. Upload your own artwork, add text, or start with one of our templates—no design experience needed. Every order includes free shipping on standard delivery, and our team is available 7 days a week to help with any questions.